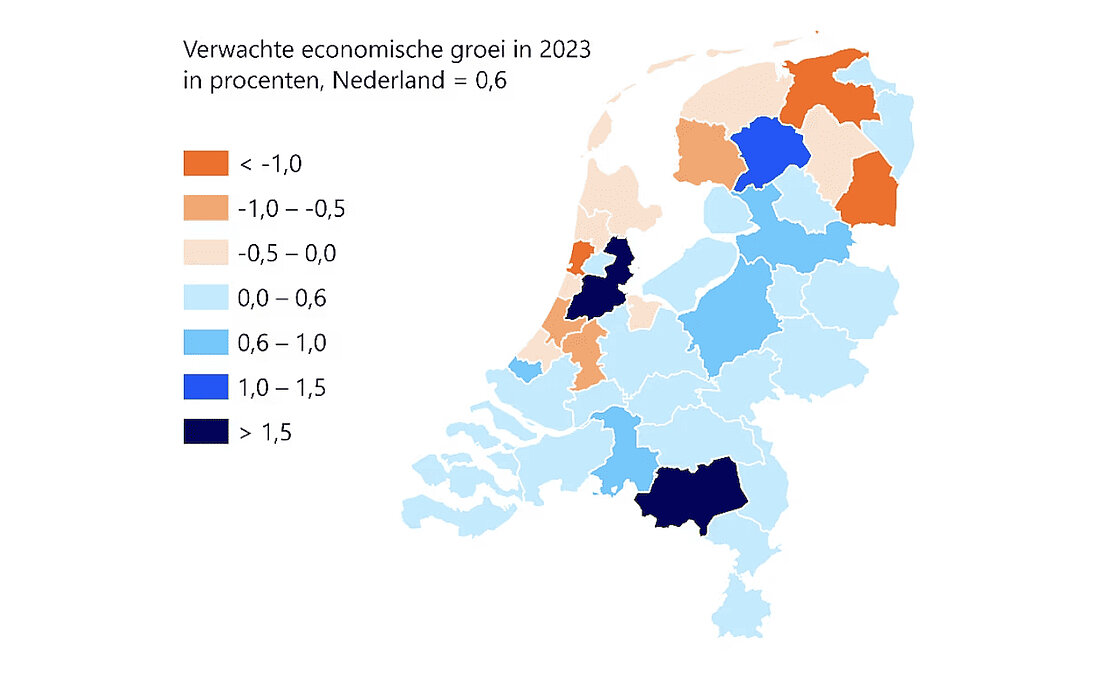

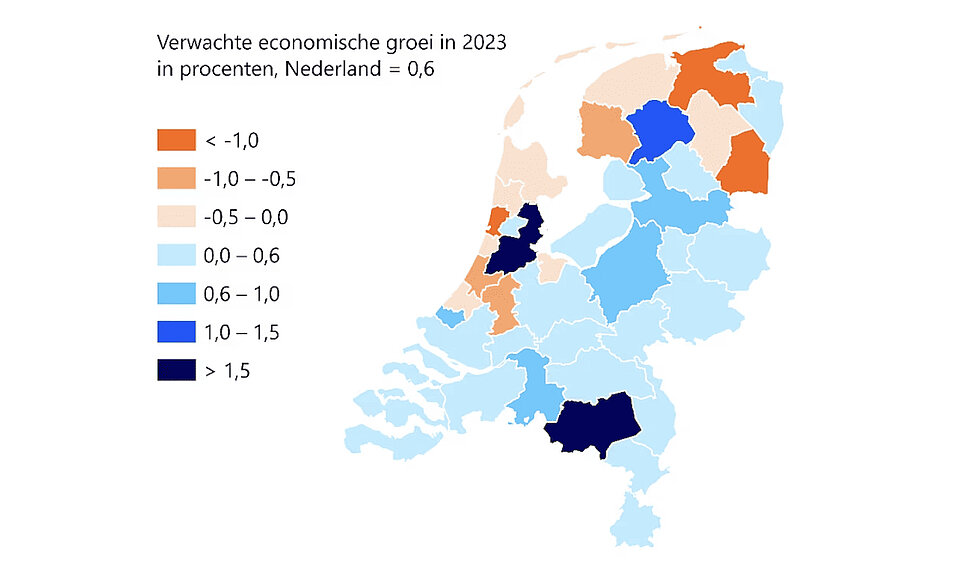

Dutch economy shows significant regional and sectoral differences

According to Rabobank, 2023 does not look rosy for most regions, with hardly any growth or even contraction. Greater Amsterdam and Brainport Eindhoven stand out positively.

In a revised forecast, Rabobank puts the growth rate of the Dutch economy for this year at 0.6 percent. Earlier this year, the forecast was still somewhat higher; the difference is largely due to the economy’s contraction in the first quarter. For 2024, the bank expects a growth of 0.9 percent. “The room for further growth is limited in the next two years by personnel shortages, among other things,” the bank writes.

“Staff shortage hinders companies’ production or operations more often than insufficient demand does.”

Meanwhile, demand for goods and services remains reasonably buoyant, driven largely by government spending and household consumption.

Construction is growing the fastest this year at 3.4 percent. ICT and business services are also growing faster than other sectors this year, albeit their growth is leveling off. “In times of macroeconomic headwinds, companies become more cost-conscious and invest less in ICT. We also see that in times of flattening sales and less growth, companies look at how they can work more efficiently, for example through automation or digitization.”

Rabobank foresees the biggest contraction in the logistics sector and industry. “But note that industry is a very diverse sector, and the differences within it are large. For example, we expect sales in the machinery industry to increase slightly in 2023, while forecasts for heavy industry – for example, the chemical industry – are more negative.” The mechanical engineering sector within the industry performed exceptionally well in recent years.

Huge regional differences

The economy in most regions will hardly grow in 2023; Rabobank foresees contraction for thirteen of the forty regions. These regions are mainly in the northern Netherlands and parts of North and South Holland (around Greater Amsterdam). The largest economic contraction is expected in the regions of ‘Overig Groningen’, IJmond, and Southeast Drenthe. This is partly due to lower revenues from mineral extraction, shrinking industry, and less favorable regional conditions.

Continue reading below the picture.

Because expectations for construction, ICT, and business services are favorable, the Veluwe and North Overijssel benefit. The ICT sector and business services are also large in Utrecht and Greater Amsterdam. Therefore, the growth rate for these regions is also higher than nationally. Southeast Friesland (around Heerenveen and Drachten), Delft and Westland, the Veluwe (around Apeldoorn and Wageningen), and North Overijssel (around Zwolle) benefit from favorable regional conditions and are therefore also expected to grow faster than nationally.

Greater Amsterdam and Brainport Eindhoven

Brainport Eindhoven (2.2 percent growth) is on the growth path known from before the corona pandemic. However, Greater Amsterdam was struck by the pandemic and did lag. But that region already grew hard last year, and Rabobank also foresees a growth of 2.5 percent for this year. Both regions owe their relatively high growth expectations mainly to favorable regional conditions, such as the high density and mass of the economy, clusters of cooperating companies, the large and well-educated labor market, and knowledge networks.

The economic prospects for Brainport Eindhoven are influenced by the fact that the specialized high-tech industry in particular is doing better than the broader industry sector. Within the industry, the (chain of companies in the) mechanical engineering sector has proven to be an important trigger (with leading world players such as ASML).