Startups in Brainport region more successful thanks to set of advantages of local ecosystem

START-UPS - To find out why startups in the Brainport region are so successful, Strategy Unit and Innovation Origins conducted a survey.

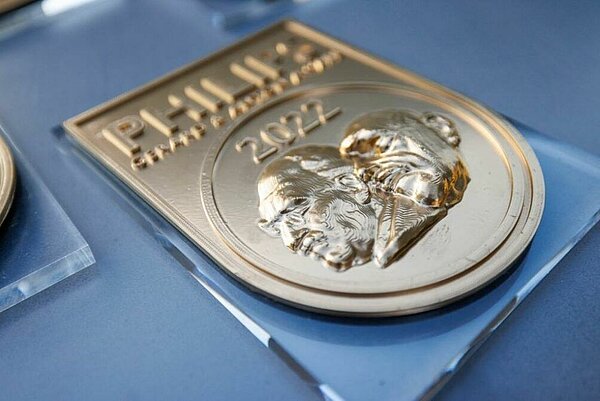

Only 16% of all Dutch startups grow into scale-ups. Boosting this low success rate of startups gets a lot of attention (among policymakers). Rightly so, as this can make a huge difference to both founders and the ecosystem. However, the success rate among former winners of the 'Gerard & Anton Awards' is above 75%. This prompted an in-depth study with the question: what factors distinguish successful startups and scale-ups in Brainport Eindhoven from the average identified by Techleap?

Strategy Unit and Innovation Origins submitted a questionnaire to all 70 winners of the Gerard & Anton Awards, followed by interviews with winners from each of the seven previous years. The Gerard and Anton Awards are presented annually to ten startups in the Brainport region from which, according to a jury, much can be expected in the coming years. The survey's questionnaire and interviews provided insights on three dimensions into the growth determining aspects in the different growth phases of these startups. The main results of the survey were announced today during the LEVEL UP event at High Tech Campus Eindhoven. The complete results will be published in October.

Two billion euros

The results of the study not only benefit startups and the local ecosystem, but they also provide pointers for other regions. They show which factors can be decisive in building an above-average successful startup climate. At the same time, they underpin the Brainport region's profile as a 'home of pioneers'. This strength is evident just from the fact that the 70 startups studied account for at least 3,350 direct full-time jobs and investments running at least close to two billion euros.

The study looked at factors along three dimensions and the foundation that Brainport Eindhoven region offers in each of the life stages of startups and scale-ups.

Business dimension

From a growth perspective, involved startups attach the greatest importance to building the team, the technical development of the product and finding the right funding. According to the interviewees, these are also exactly the factors where the Brainport Eindhoven region offers them support.

Cluster dimension

Decisive for the growth of startups is above all that the cluster is open to mutual cooperation, that there are attractive work locations and that the ecosystem contributes to solving major social issues. Especially with the first two, the cluster is actually seen as a tool to achieve growth.

Agglomeration dimension

At the level of the environment (the 'agglomeration'), startups consider sufficient access to talent and (applicable) knowledge to be decisive. On both aspects, the Brainport region scores high, which also applies to the organisation of a system of regional cooperation.

Life stages

The importance of and satisfaction with these factors changes according to a startup's life stage. Across the board, we find that satisfaction with the Brainport region is high, but decreases slightly as the company develops. In the idea phase, this enthusiasm is high to very high, in the startup phase it decreases slightly to arrive at a score in the middle between high and low in the scaleup phase.

Idea phase

In the idea phase of the startup, the strong and accessible communities within Brainport are the most important distinguishing element of the region, closely followed by the strong contacts between knowledge institutions and entrepreneurs and the presence of young talent to form the team. At this stage, there are also wishes for improvement. These lie, according to the startups interviewed for Brainport, in the (too) complicated funding processes and in housing, among other things. In addition, the younger teams still too often struggle to penetrate the region's big corporates, both as customers and in terms of substantive help. Brainport's much vaunted cooperation model ('triple helix') is not yet a given for the younger generation. All age groups see great opportunities for the region at this stage if the emphasis in communication could shift from the big corporates to the startups present.

Startup phase

In the startup phase, the presence of talent remains visible as a regional advantage. But even more important in this phase, according to the startups, are the rich infrastructure for specific support (incubators, accelerators, counters like The Gate and Brainport Development but also the infrastructure of the big campuses) and the knowledge-intensive hinterland: there is always a research group with expertise. The improvement wishes in this phase are mainly around obtaining financial support, not only because of the complicated and time-consuming processes required for this but also because of the fragmented playing field. A frequently mentioned irritation in this phase is the increasing activity of headhunters trying to lure 'your' people away from your startup.

Scale-up phase

In the scale-up phase, local opportunities around support, investment and customer relations due to the presence of large tech companies are most important. Physical preconditions such as business premises are also still a distinctive advantage in this phase. Interestingly, the presence of talent is seen less as an advantage in this phase, especially since most scale-ups see the whole world as their field of operation, especially when it comes to attracting staff. Exactly this aspect also directly poses a bottleneck: for almost all scale-ups, the lack of accommodation options for staff who are not from the region poses a concrete risk to the company's growth. In addition, respondents urge further diversification of the ecosystem to reduce dependence on a handful of large companies.

The report with all the details from the survey will be released at the end of October.