Brainport voor Elkaar

Equal opportunities for all. That is the goal of Brainport voor Elkaar. Our association of social employers connects companies, social organisations, municipalities and education. We join forces and work together on social issues in the region. Because together we achieve more.

Get involved!

In Brainport, we have already proven that working together makes for economic success. By joining forces in an association of social employers, we will achieve more. Together, we will make this region a place where there is attention for everyone.

Will you join too?

More about membership

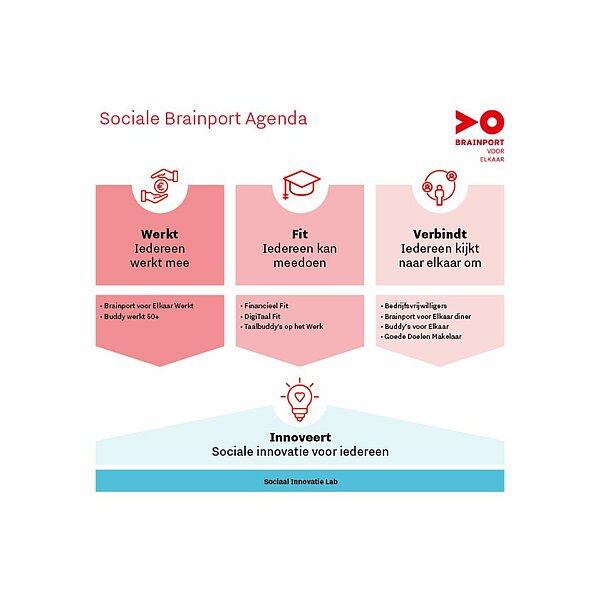

What we do: our Social Brainport Agenda

Ensuring that all residents can participate is the main goal of Brainport voor Elkaar. Together with all members, we determine our activities on the basis of our Social Brainport Agenda. For 2025, we are working on four programme lines.

"With regularity I see people, who can't keep up enough and therefore fall outside the boat. Only when all residents experience the benefits and can be proud of their Brainport region, the success is truly complete."

Janneke van Kessel, city envoy Municipality of Eindhoven

About Brainport voor Elkaar

Brainport voor Elkaar is an association of social employers. Governments, companies, civil society organisations and educational and knowledge institutions are working together to make our region a social success.

More about us